You should already have received our legal guidance and recommendations on the ICMS-DIFAL tax regime in interstate sales operations for non-taxpayers of ICMS.

We now send our considerations about interstate fixed asset and material purchases of use and consumption among ICMS contributors, which are more complex and important.

It should be taken into account that, despite the distinction between ICMS taxpayers or non-taxpayers, for the former transactions deal with the purchase of goods and services for final consumption, not intended for resale or industrialization. (in these cases ICMS – DIFAL taxpayers are the buyers of goods and services – materials of use and consumption and fixed assets).

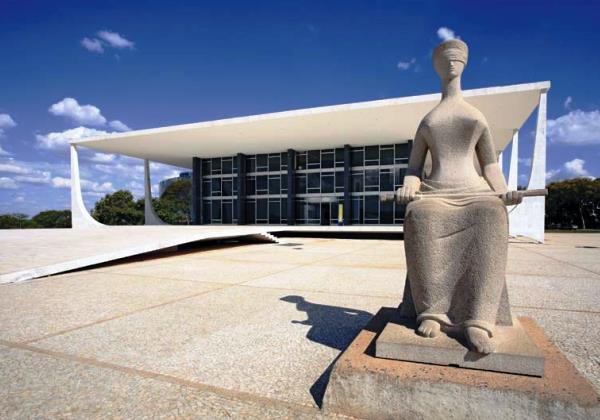

As may have been verified, in the Supreme Federal Court ruling on ICMS – DIFAL tax regime the legal basis is the need for complementary law for the incidence and collection of said tax.

With the edition of Complementary Law No. 190, of January 4, 2022, the determination of the Supreme Court was met for both sales/purchasing operations between taxpayers, and those with of ICMS non-taxpayers, and there is now a legal provision for the incidence of ICMS – DIFAL in both operations. (sales/purchases between ICMS taxpayers of goods and services for final consumption (fixed assets and materials of use and consumption), and those made by ICMS non-taxpayers.

States have supported that they do not depend on the new Complementary Law No. 190/22, and could exercise full competence to dispose of the incidence and collection of ICMS-DIFAL in use and consumption operations by ICMS taxpayers.

However, even with the passing of Constitutional Amendment No. 87/2015, in which the tax legal relationship was created, the previous existence of a Complementary Law is fundamental to legitimize the incidence and collection of ICMS – DIFAL. Therefore, it is up to the Supplementary Law, in tax matters, to establish general rules on generating facts, calculation bases, taxpayers and tax liability (art. 146, items I and III, a and b), as well as establishing general rules on tax legislation.

Hence, in relation to ICMS, it is up to the Complementary Law to define taxpayers, to dispose of tax substitution, tax compensation, to stipulate the place of operations for the purposes of collection and definition of the establishment responsible for its collection and to establish the basis of calculation (art. 155, § 2º, XII, a, b, c, d e i).

Even with the so-called Kandir Law (LC No. 87/96) there was no standard (until 01.05.2022) authorizing the States and the Federal District to establish the taxation provided for in Article 155, § 2º VII and VIII of the Federal Constitution, in the event taxpayer is actually the consumer and neither there is an Agreement regulating this hypothesis. Even if there were, it would be unconstitutional for it is not a competency conferred to the Complementary Law.

Moreover, such legislative omission (because LC No. 87/96 is a constitutional rule of limited effectiveness) is ratified by the fact that there are two ongoing bills in Congress aiming at full applicability to said constitutional rule (tax hypothesis) via the implementation of infra-constitutional norms (PLP 218/2016 and PLP 325/2016).

Thus, considering the need for national Complementary Law regulating EC No. 87/2015, as determined by the Supreme Court, pursuant to Article 146 of the Federal Constitution, and, considering that the mere constitutional provision is not enough to legitimize the collection of DIFAL in the hypotheses of interstate sales for use and consumption, even involving ICMS taxpayers, it is a competing legislative competence, which presupposes general guidelines to dispose of the basis of calculation, generating facts and taxpayers, it is our understanding that there is no legal basis for the incidence and collection of ICMS – DIFAL in these operations; that is, ICMS is undue as a differential of rates, in the operations of interstate acquisition of goods for use or consumption or destined to fixed assets.

Therefore, there are two tax opportunities: one behind ICMS – DIFAL for taxpayers who collected ICMS-DIFAL in the purchase of material of use and consumption and fixed assets (for those who did not take credit), for offense to the principle of legality due to the lack of complementary law, and another ICMS – DIFAL for taxpayers – related to the ninety-day principle and previous exercise.

According to these legal grounds, it is appropriate to refund the amounts of the last five years, as well as, by provisional protection or injunction, to suspend the enforceability of ICMS-DIFAL for offense to the principle of strict legality in tax matters and the principle of Non-retroactivity.

So, the tax regime of ICMS – DIFAL in purchases of use and consumption, and of fixed assets, destined to ICMS taxpayers, was thus fixed, according to our legal evaluations:

Legal premises:

1 – What operations are covered, even if the Supreme Court has not yet officially manifested?

Answer: INTERSTATE PURCHASES FOR USE AND CONSUMPTION OF GOODS AND SERVICES BY ICMS TAXPAYERS

2 – Who is the DIFAL taxpayer in interstate operations among ICMS taxpayers?

Answer: In the operations provided for in item 1, the buyer of the goods and services is the taxpayer of DIFAL, and must collect the difference in rate for the state of their location.

3 – Date of publication of Complementary Law 190, of 01/04/2022, published in the Official Gazette of 01/05/2022)

- Purchases of goods and services for use and consumption as well as fixed assets made in the period from 01/01/2022 to 04/03/2022, will have no incidence of DIFAL, depending on the legislation of each State of the Federation; for companies that buy fixed assets and opt for ICMS-DIFAL credit, there will be no risk or tax contingency; for purchases of goods for use and consumption, we recommend the application of the appropriate judicial measures, in case the States require the collection of ICMS – DIFAL.

- purchases of goods and services for use and consumption as well as fixed assets made in the period from 12/04/2022 to 12/31/2022, will have incidence of DIFAL, depending on the legislation of each State of the Federation. (see note (1) below)

IMPORTANT NOTE (1) In the cases of the letter “b” of item 3, we also recommend the assessment of appropriate legal measures, because the incidence, in respect of the ninety-day principle, should occur only for sales from 01/01/2023.

IMPORTANT NOTE (2): In case preliminary injunction is not issued suspending the collection and application of fines and interests, we recommend making the judicial deposit of ICMS – DIFAL.

IMPORTANT NOTE (3): We note that the respective legal measures must be filed at the venue / address of the ICMS taxpayer buyer.

We request analysis of the operations in the purchase of goods and services – fixed assets and materials of use and consumption, to verify whether they fit the rules defined above, for the use and recovery of undue ICMS – DIFAL collection.

We are at your disposal for further clarification deemed necessary.